Minimum Price Explorer

In this interactive essay, drag any number left or right to alter your pricing destiny!

What is the lowest price you can put on your product and still cover costs?

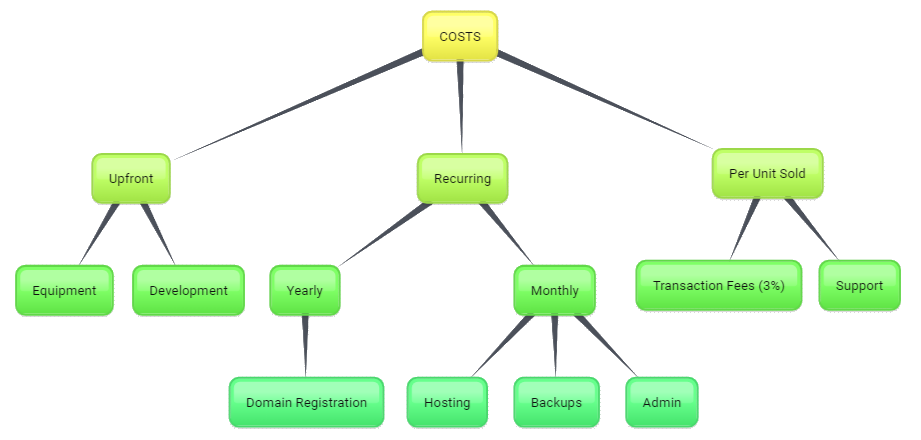

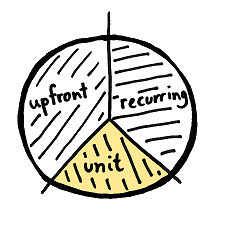

In order to estimate this figure, you need to understand three different types of costs your business will face.

We'll explore each of these costs, and you can change the figures to see the minimum price you can charge before you start turning a profit.

Upfront investments

We can call these "upfront costs", but it's a good psychological (and accounting) trick to call them "upfront investments" so we feel a little better about the money we see dissappear.

If you value your time at , and spend creating your amazing product, then you'll want the sales to "pay back" over the lifetime of the product.

If the product has a lifespan of (i.e. months) then you'll need to sell, on average, worth of product every month to recover that initial time investment. (We gloss over the time value of money for simplicity, but suggest it as further reading.)

You might have invested more time or money upfront. Perhaps you bought a laptop, paid for some software development licenses, bought a fascinating ebook called "Your First Product", attended courses, or even just bought some stationery. Add all of those costs together, let's say it comes to . If you pay that back over the lifespan of the product (), then it will cost you another .

So the upfront development plus your other upfront costs will require sales totalling before you make any profit at all.

Recurring costs

Now we turn our attention to recurring costs: costs that happen every month whether you sell 0 copies or 1 million copies.

Let's say you pay for hosting, and to have your own domain name. You may also pay for transport layer security, as much as . Those figures will cost you a total of .

You'll probably invest a few hours in your business every month: perhaps writing content for your webpages, attempting to get traction on social media or tinkering with advertising and promotional ideas. If that totals , and you value your time at (from above), then all of this time is costing you . This is usually one of the biggest costs of your business.

We can now see that the recurring cost is ( plus )

Total of upfront and recurring costs

Well, now we are in a much better position to consider a minimum price for your product.

Every month, to cover costs, you need to bring in ( of recurring costs, plus to cover upfront investment)

In other words if you price the product at you'll need to sell before you make a single dollar in profit. (And every copy after that is pure profit! Well, not quite... there's one more section below, covering your unit costs.)

Or, we can phrase this the other way around. If you think you'll struggle to shift , you'll need to set the price higher than .

Unit Costs

A certain percent of your customers will ask for support. And each one of those support questions will take you a certain amount of time. If, for example, % of customers need help, averaging minutes, then your support cost per sale is , and you need to pour this amount straight on top of the minimum price we calculated above.

Finally there's the thorny issue of advertising, which seems to power everything we experience. You may not be paying for advertising at all and getting all your customers from word of mouth referrals. But if you do use advertising, it will most definitely increase your unit costs. Perhaps only % of your customers arrive due to advertising (and the other % are achieved organically). If you spend , and % of those clicks into actual customers, you've just added a further to your minimum price for all customers (even the ones who arrived by word of mouth!)

So your unit costs are (people often refer to this as your "marginal cost"). Set the price lower than that and achieving more sales will only make you poorer!

| Type | Value |

|---|---|

|

Upfront Costs (equipment/development) |

once only (or simply treat it as ) |

| Recurring Costs | |

|

Unit Costs Marginal cost |

And the minimum price is...

Now we've really covered everything. We've covered upfront costs, recurring costs and unit costs, and can finally take a good look at the minimum price of your product.

If you price the product at you'll need to sell before you make a single dollar in profit. For every copy after that, you'll get to keep from each sale.

Or, if you struggle to shift , you'll need to set the price higher than if you want to make any money at all.

And the great news is that if you manage to sell at a price of , then your annual profit will be a neat .

| Figure | Value |

|---|---|

| At this price | |

| You must sell | |

| And you will make | |

| Hence, if you can shift | |

| Your annual revenue is | |

| Your annual profit is |

Another way to look at it is....

| Figure | Value |

|---|---|

| If you can sell | |

| You must set a price higher than | |

| And if you set the price at | |

| Your annual revenue is | |

| And your annual profit is |

How to actually price your product...

And all of that is just a tiny footnote before we look at what actually matters when setting a price for your product.

Yes, you have to ensure the price is above the minimum. But how high should you go? What actual price should you set? There's a whole lot more to consider, including competitors, customer perception, segmentation, and oodles of economic theory. As well as the Patrick Principle. But I'll get to all of that in time.

My book "Choose Your First Product" is available now.

It gives you 4 easy steps to find and validate a humble product idea.